SoFi® Checking & Savings Review: A Bank Account with a Cash Bonus

SoFi Money

Product Name: SoFi Money

Product Description: SoFi’s bank account is a checking and savings combination that earns a high interest rate.

Summary

SoFi is a student loan company that has added a bank account. This account is a checking and savings combo with few fees and no minimum deposit and earns a high interest rate.

Pros

- Competitive interest rate

- No fees whatsoever

- No account minimums

- ATM fee reimbursement

Cons

- Online bank, no physical branches

- Few account options

- Low limits on peer to peer transfers

SoFi® made its name as a modern and more “fun” student loan refinancing company. Why were they fun? Not only did they offer low rates on student loan refinancing, but they also held events throughout the year and even offered career services.

They held education events that included networking events, happy hours, and other similar “experiences.” This helped them build one of the largest student loan refinance companies in the United States, with over 800,000 members.

It was a different approach to student loans. Up until then, most loan providers competed on price (interest rate on the loan). While SoFi competed on price, too, they also offered value-added bonuses that helped people fall in love with them.

They have since branched out to several other products, including deposit accounts.

Table of Contents

Yes — they did not start off as a bank, but they received regulatory approval to become one.

But they are now officially a bank with their own FDIC insurance offered through SoFi Bank, N.A. They have the standard $250,000 of insurance, but they also have up to $2,000,000 through the SoFi Deposit Protection program.

Your money is safe there.

SoFi Checking & Savings Account

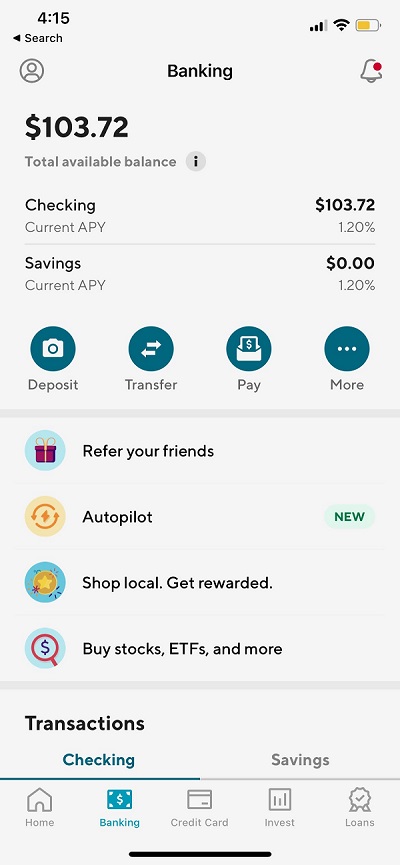

Sofi Checking and Savings is a single “product,” but you get a separate checking and savings account. Both accounts have a high interest rate, and you get a debit card that transacts on the checking account.

There are no account fees and no account minimum. There is no monthly maintenance fee, no non-sufficient funds fee, and no overdraft fees. You can get personal checks for free as well as bill pay and transfers. If you use the debit card outside of the United States, they will not charge a foreign transaction fee either (they will pass on the 1% fee that Visa charges).

There are also no ATM fees — they will reimburse you for any ATM fees as long as you use an ATM with a Visa®, Plus®, or NYCE® logo.

Finally, you get a membership to SoFi, which means you can attend those events I talked about in the opening section. While this isn’t an exclusive membership, it is a nice little perk you can take advantage of as long as you live near where they hold these events.

SoFi Bank is a member FDIC and does not provide more than $250,000 of FDIC insurance per legal category of account ownership,as described in the FDIC’s regulations. Any additional FDIC insurance is provided by the SoFi Insured Deposit Program. Deposits may be insured up to $2M through participation in the program. See full terms atSoFi.com/banking/fdic/termsSee list of participating banks atSoFi.com/banking/fdic/receivingbanks

Sofi’s account fee policy is subject to change at any time.

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.50% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 8/27/2024. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

Overdraft Coverage is limited to $50 on debit card purchases only and is an account benefit available to customers with direct deposits of $1,000 or more during the current 30-day Evaluation Period as determined by SoFiBank,N.A. The 30-Day Evaluation Period refers to the “Start Date” and “End Date” set forth on the APY Details page of your account, which comprises a period of 30 calendar days (the“30-DayEvaluationPeriod”). You can access the APY Details page at any time by logging into your SoFi account on the SoFi mobile app or SoFi website and selecting either (i)Banking> Savings> Current APY or (ii)Banking> Checking> Current APY. Members with a prior history of non-repayment of negative balances are ineligible for Overdraft Coverage.

Vaults

Vaults are like sub-accounts in your Sofi account. They’re not separate accounts but ways for you to think about various savings goals.

You can set up a Vault for an emergency fund, to save for your first house, or to buy a new car. They all earn the same interest rate.

You can have up to 20 vaults at one time and there are no additional fees or minimums on vaults.

The only thing you can’t do is spend money from a Vault. You can only spend it from your main Sofi account. If you want to spend it, you have to transfer it from the Vault to the main account.

If your main account runs out of money, you can set up “reserve spending” so that money in your vault can be used to cover transactions in your main account. If you set this up, it’ll move money so transactions are approved. If you don’t, the transaction won’t be approved.

There are rare cases when they will override reserve spending to move money in the case of:

- Checks and ACHs deposited into your spending balance that are returned or reversed

- Debit card purchases that pre-authorize a lower amount than the final transaction amount (examples include gas station purchases and restaurant tips).

Finally, if you close a vault, that money goes directly into your main spending balance.

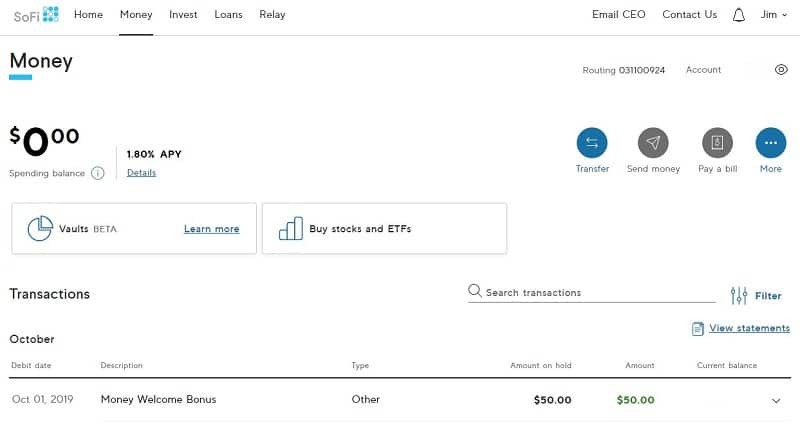

Account Opening Walkthrough

Opening an account takes just 7-8 minutes.

The first page is to register for Sofi, including name, email, and password.

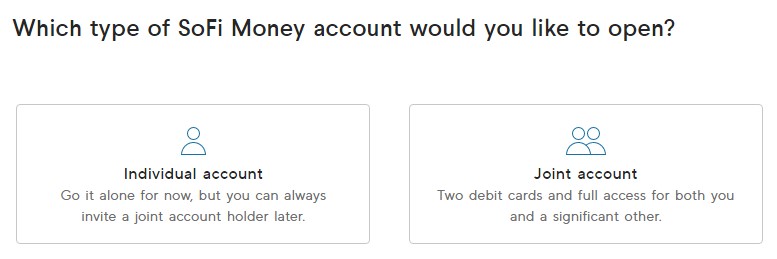

Then, you pick whether to open an individual account or a joint account.

To keep things simple, I opened an individual account.

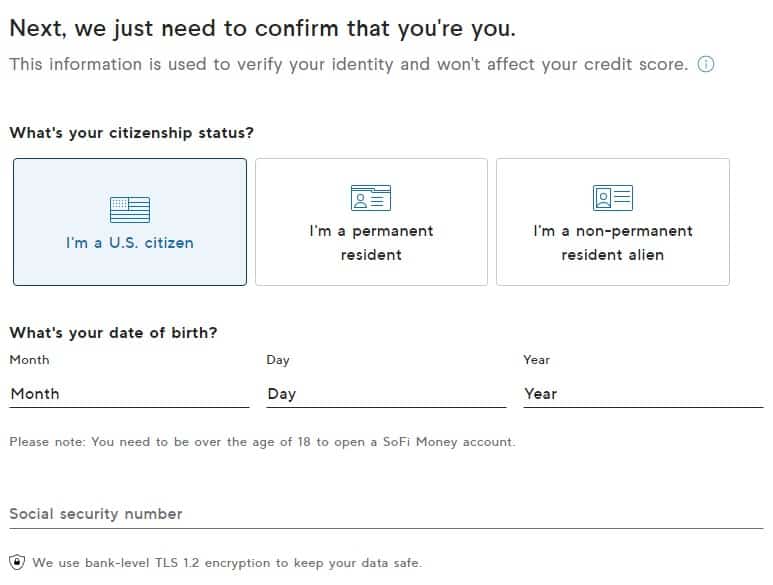

Next, you have to enter your permanent address. They use a tool that helps populate the address, similar to how Google Maps auto-populates as you type, so it’s super fast. Then you enter a phone number that they use for two-factor authentication.

Finally, you have to confirm it’s you with your date of birth and Social Security Number:

(there’s one more regulatory page asking questions like whether you’re an officer of a publicly traded company, FINRA, etc.)

Then, boom – you’ll probably be confirmed!

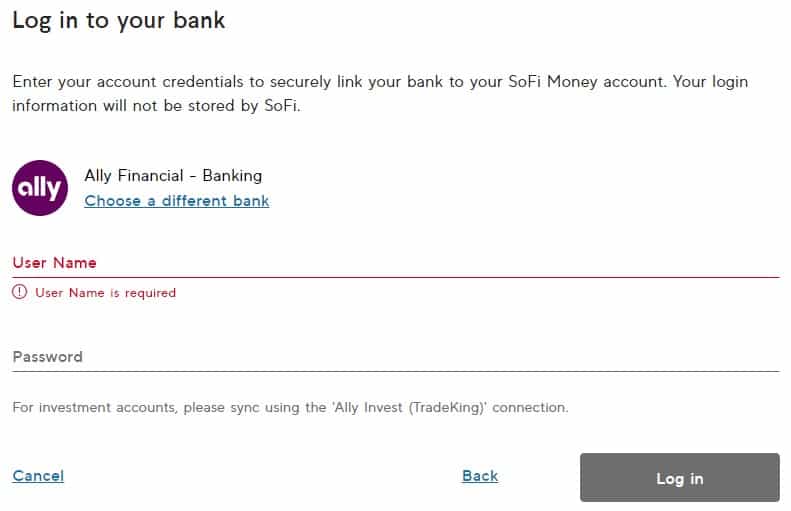

Linking up an account is super easy too, just have to log in with your credentials.

(the image shows Ally Bank but I opted to link up Bank of America)

It takes just a couple of days for the transfer to complete, a typical amount of time for an ACH transfer.

And just like that, we’re off and running.

The Money Welcome Bonus of up to $300 is the referral bonus they offer if you open an account using an existing member’s referral link and receive qualifying direct deposits totaling at least $5,000. (here’s our list of all of SoFi’s bonuses)

Any Catches?

SoFi limits you to a certain number of transactions to prevent fraud.

For peer to peer withdrawals, you are limited to $250 per day and $3,000 per month. Bill pay is limited to $10,000 per transaction.

Through ATM or Point of Sale Cash Withdrawal, you are limited to $610 (Ally Bank limits you to $1,000 per day). Over-the-counter cash withdrawal is limited to $150, and your Point of Sale spend limit is $3,000. Finally, you’re limited to 12 point-of-sale transactions per day.

These are not onerous limits, but there may be times when you will run into them.

Lastly, no wire transfers.

Want to get up to $300 to open an account? SoFi Money will give you up to $300 if you open your account and satisfy a few other conditions.

It’s just that simple. And once you’re done, you can refer your friends and give them $25 a pop too.

Everyone wins!

Learn more about SoFi Checking & Savings

Disclosure: New and existing Checking and Savings members who have not previously enrolled in Direct Deposit with SoFi are eligible to earn a cash bonus when they set up Direct Deposit of at least $1,000 during the Direct Deposit Bonus Period. Cash bonus will be based on the total amount of Direct Deposit. Direct DepositPromotion begins on 12/7/2023 and will be available through 12/31/24. Full terms at sofi.com/banking. SoFi Checking and Savings is offered through SoFi Bank, N.A., Member FDIC.

SoFi members with Direct Deposit or $5,000 or more in Qualifying Deposits during the 30-Day Evaluation Period can earn 4.50% annual percentage yield (APY) on savings balances (including Vaults) and 0.50% APY on checking balances. There is no minimum Direct Deposit amount required to qualify for the stated interest rate. Members without either Direct Deposit or Qualifying Deposits, during the 30-Day Evaluation Period will earn 1.20% APY on savings balances (including Vaults) and 0.50% APY on checking balances. Only SoFi members with direct deposit are eligible for other SoFi Plus benefits. Interest rates are variable and subject to change at any time. These rates are current as of 8/27/2024. There is no minimum balance requirement. Additional information can be found at http://www.sofi.com/legal/banking-rate-sheet.

Other Posts You May Enjoy:

CreditFresh Review: Quick Credit Approvals – Is it Worth the Cost?

CreditFresh offers a line of credit that allows you to make on-demand withdrawals. It’s possible to qualify for a borrowing limit between $500 and $5,000 while avoiding hidden fees. This CreditFresh review covers the strengths and weaknesses of this borrowing option and whether this is the best way to borrow money.

WiserAdvisor Review: A Legit Way to Find an Advisor?

Finding a financial advisor you can trust can be challenging. Thankfully, WiserAdvisor can match you with professional advisors in their network that they have vetted in advance. The best part is that their service is free, and there’s no obligation. But is WiserAdvisor a legitimate platform? Find out in this full review.

Motley Fool Review 2024: Is Stock Advisor Worth It?

Motley Fool Stock Advisor $99 / first year Product Name: Motley Fool Stock Advisor Product Description: Motley Fool Stock Advisor…

Empower Personal Dashboard [Personal Capital] Review 2024 – How I Track My Investments in 15 Minutes a Month

Empower Personal Dashboard FREE Product Name: Empower Personal Dashboard Product Description: Empower Personal Dashboard tracks your net worth, monthly cash…

About Jim Wang

Jim Wang is a forty-something father of four who is a frequent contributor to Forbes and Vanguard’s Blog. He has also been fortunate to have appeared in the New York Times, Baltimore Sun, Entrepreneur, and Marketplace Money.

Jim has a B.S. in Computer Science and Economics from Carnegie Mellon University, an M.S. in Information Technology – Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University. His approach to personal finance is that of an engineer, breaking down complex subjects into bite-sized easily understood concepts that you can use in your daily life.

One of his favorite tools (here’s my treasure chest of tools, everything I use) is Empower Personal Dashboard, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you’re on track to retire when you want. It’s free.

Opinions expressed here are the author’s alone, not those of any bank or financial institution. This content has not been reviewed, approved or otherwise endorsed by any of these entities.